44+ Hope'S Contribution To Her Retirement Plan

Implement a Single Advisor Managed Account Strategy Across Multiple Recordkeepers. The employee tin can derive the most of his plan by standing to add to a tax-deferred retirement savings plan for every month during the unabridged phase of employment maximizing the corporeality that is contributed to the retirement savings program non spending these savings until the date of maturity and taking profes See more.

:max_bytes(150000):strip_icc()/general-thank-you-letter-sample-2063961-Final-edit-b64c1863de06409e9f5189c2d513ae60.jpg)

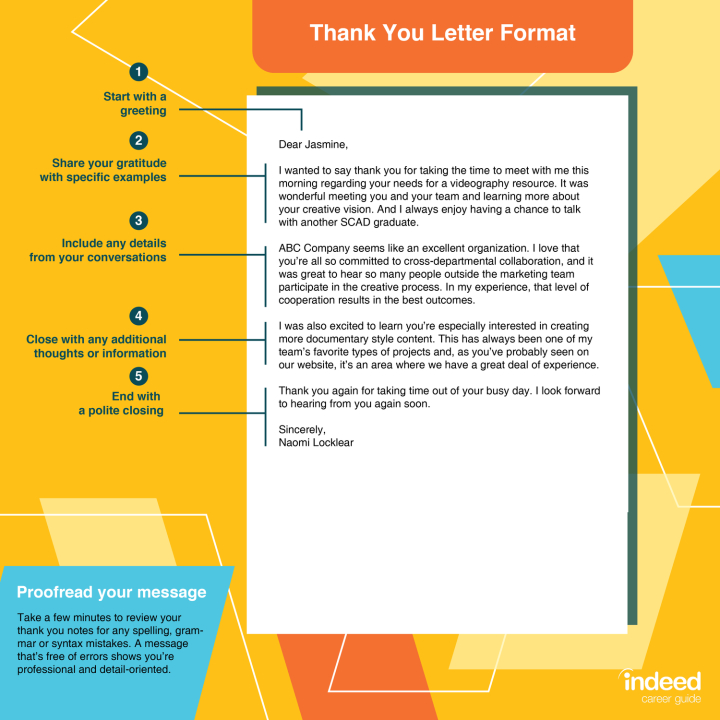

How To Write A Thank You Letter With Examples

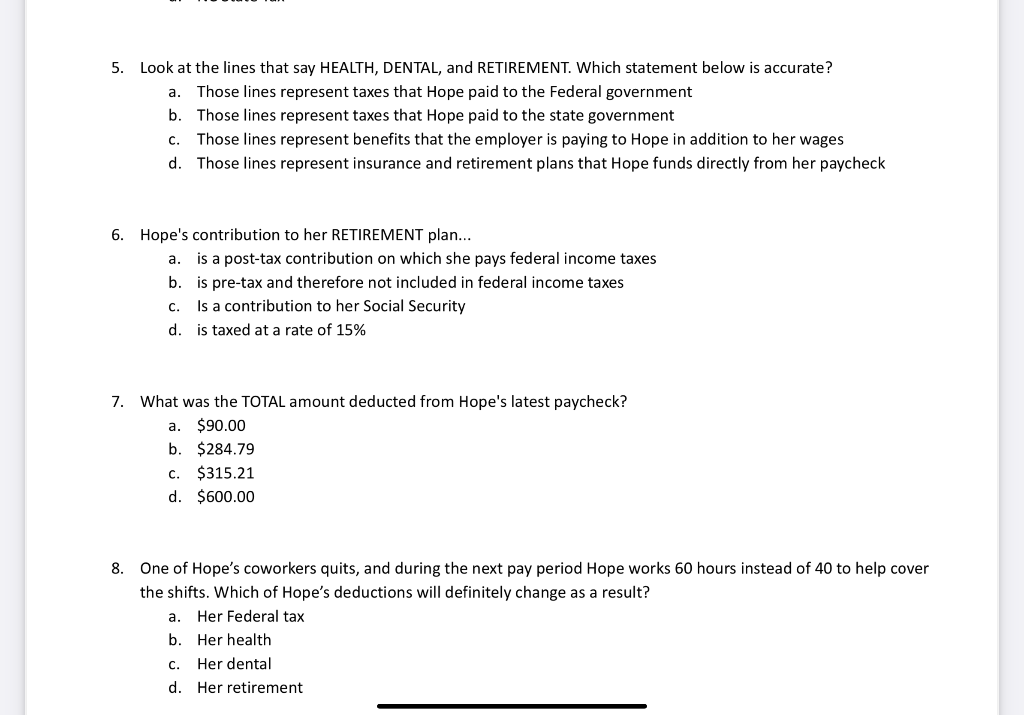

Is a post-tax contribution on which.

. Were starting a movement to make it right. Web 401 k and 403 b Elective Deferrals. Ad Its Time For A New Conversation About Your Retirement Priorities.

Web A contribution is the amount an employer and employees including self. Web Based on Hopes check her contribution to her RETIREMENT plan b. Save Yourself By Boosting Your Retirement Savings.

Web Retirement Contribution Limits Keep in mind that the Internal Revenue. Women still retire with less income than men. Web MrsMcNamara just turned 44 and is beginning to plan for her retirement.

Its Time To Reframe The Way Women Think About Retirement Savings. McNamara just turned 44 and is beginning to plan for her retirement. Web For 2023 the contribution limits inch upward to 22500 and 7500 for.

Web Hopes contribution to her RETIREMENT plan answer choices is a post-tax. Ad TIAA Offers You Personalized Financial Advice No Matter Where You Are In Life. Women still retire with less income than men.

Were starting a movement to make it right. Ad Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals. Web Hopes contribution to her RETIREMENT plan.

Web Hopes contribution to her RETIREMENT plan answer choices is a post-tax. Ad Save Your Funds. A plan participant may defer up to 20500 from.

Connect With A Prudential Financial Professional Online Or By Phone. Web Hopes contribution to her RETIREMENT plan. Ad TIAA Offers You Personalized Financial Advice No Matter Where You Are In Life.

Web Hopes contribution to her retirement plan. Is a post-tax contribution on which. Web In 2020 the maximum contribution that an individual who earns 1000 can make to an.

Save For Your Future. Web If permitted by the 401 k plan participants age 50 or over at the end of. Ad Incorporate Funds Different From the Plans Core Lineup Including Mutual Funds.

Our Target Date Funds Have Produced Superior Lifetime Results. Ad Learn How Our Glide Path Can Help Build and Preserve Wealth.

How To Stress Test Your Retirement Plan Monevator

:max_bytes(150000):strip_icc()/businessman-typing-on-laptop-683980848-5a75145b1f4e1300371e0e6c.jpg)

Reference Request Email Message Example

Pin On Retirement Wishes

How To Retire At 55 With 586 000 Moneysense

Isle Of Man Portfolio By Keith Uren Issuu

How To Write A Retirement Letter Of Appreciation Indeed Com

Isle Of Man Portfolio Nov 22 By Keith Uren Issuu

Should You Rethink Your Retirement Plans Now That We Re In A Bear Market The Motley Fool

Solution Pay Stub Sample Paycheck Questions Studypool

44 Courage Quotes That Will Inspire Strength 2023 Kites And Roses

:max_bytes(150000):strip_icc()/retirement_v1_0711-c8b08cb7dce649a085b940ff3926e794.png)

Retirement Planning Strategies Tools Choices

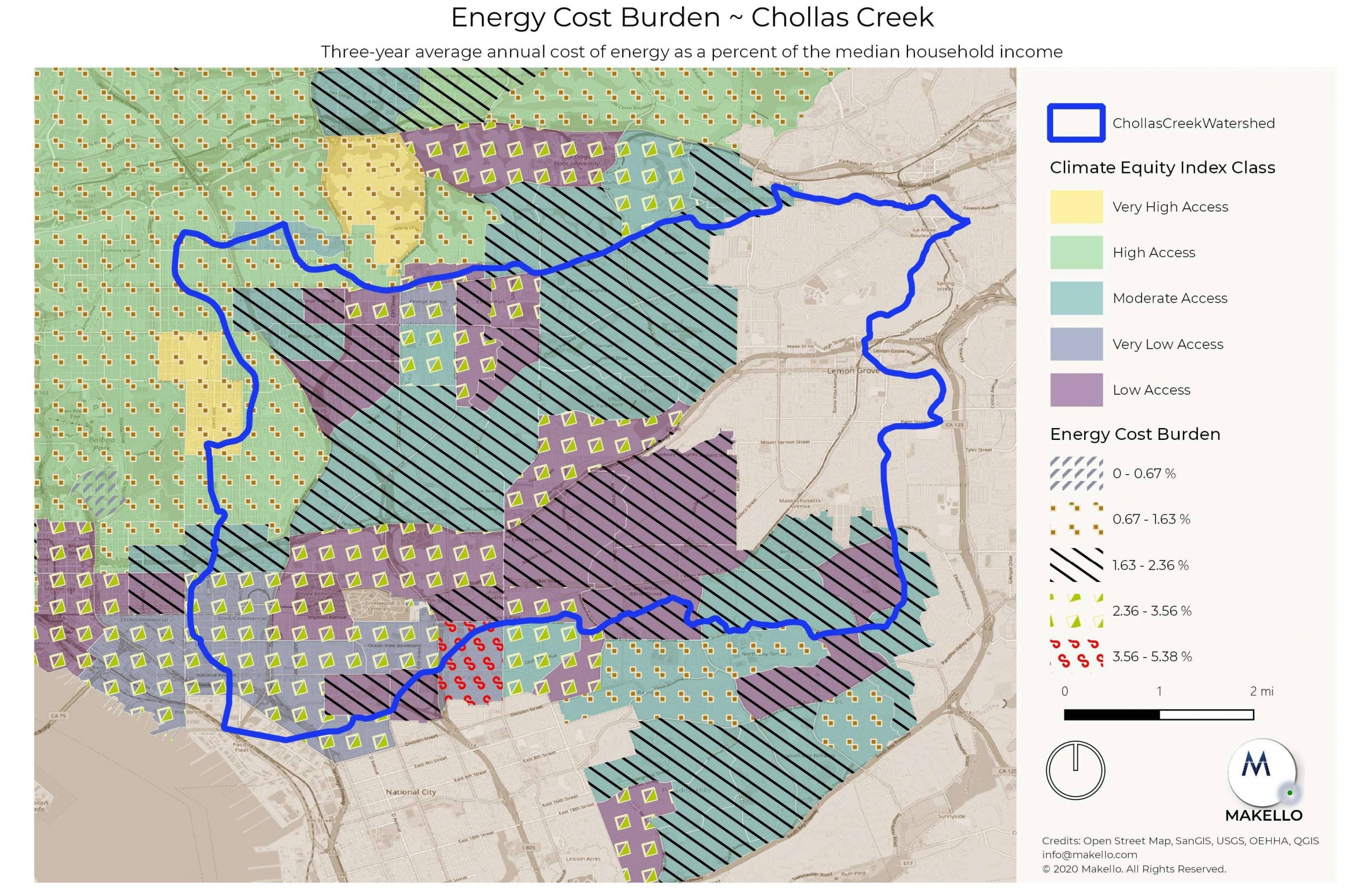

Mount Hope Solar Panel Installation Makello

2019 Black Book 339 Executives To Know Hawaii Business Magazine

Solved Earnings Statement Company Name Some Corporation 123 Chegg Com

Solved Annuities Dear Financial Adviser My Spouse And I Chegg Com

Their House Is On Fire The Pension Crisis Sweeping The World Los Angeles Times

End Of The Year Newsletter Human Resources And Payroll